E Pcb Tax

Nota Penerangan Jadual PCB 2012. Log into the e-Data PCB portal.

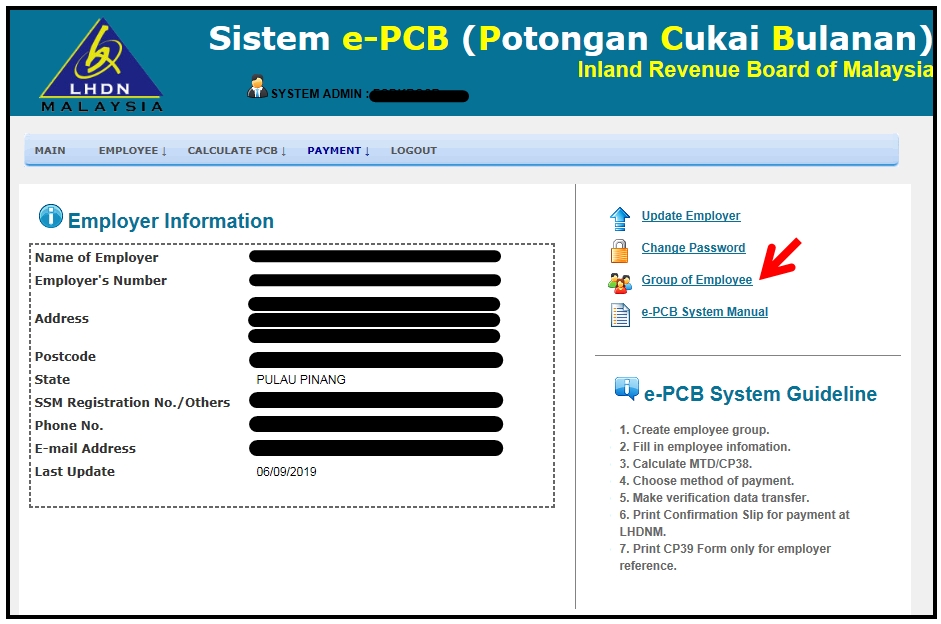

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

If payment has not been made.

E pcb tax. Nota Penerangan Jadual PCB 2010. Sistem e-PCB disediakan untuk kegunaan majikan yang tidak mempunyai sistem penggajian berkomputer untuk. The payment received date is the payment date through FPX.

Do I need to file tax returns. The Simple PCB Calculator is compatible in most popular browsers. Submit and make payment.

All Right Reserved e-Apps Unit Department of e-Services Application Inland Revenue Board of Malaysia. Calculate monthly PCB deductions. Because by meeting these conditions your MTDPCB paid is considered as a final tax.

Nota Penerangan Jadual PCB 2013. If the payment has been made. The FPX service is provided by these banks.

Once the user is registered in the portal instead of manual data adjustments employer can simply upload the PCB file. It aims to be the minimalist alternative to the Official PCB calculator. Memastikan PCB yang dikira betul dan tepat.

PCB is the Malaysian monthly tax deduction - Potongan Cukai Bulanan. Find your PCB amount in this Income tax PCB 2009 Chart. Submit PCBCP38 detailed payments online.

The slip bank is an acknowledgement receipt of payment by the employers. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and children relief. E-Data PCB For automated submission of monthly tax deduction of registered users.

E-Data PCB users can choose to pay their PCB either through online by using FPX Services or at selected banks. Upload the PCB txt file that is. Log into the e-Data PCB portal.

Ensure PCBs are calculated accurately. PCB is deducted from the employees salary and it is the employers responsibility to ensure that the necessary amount is deducted accordingly. Your MTDPCB is under the Income Tax Deduction from Remuneration Rules 1994.

The PCB calculation is. Sistem ini juga membantu majikan untuk menyimpan maklumat pekerja dan mengemukakan data bayaran PCB secara dalam talian. Amend the PCB txt file to contain only the outstanding payment information.

Borang PCB TP2 2010. Mengira PCB pada setiap bulan. Employers who do not have a computerized payroll system can benefit from the e-PCB system.

E Total amount of tax to be deducted in the month that Bonus is paid will be A D. Sistem ini disediakan untuk majikan yang tidak mempunyai sistem penggajian berkomputer untuk mengira dan menyemak PCB. EPF deduction is restricted to RM500 only any amount above RM500 is consider lost.

Borang PCB TP1 2010. This means your employer will withhold the required amount of tax each month automatically and pass it over to the tax authorities. Please check your email and click on link provided to activate the account after.

Your employment income is prescribed under Section 13 of the Income Tax Act 1967. Calculate your taxable salary Taxable Salary Gross Salary EPF EPF is equals to your 11 gross salary. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

You serve under the same employer for a 12-month period in a calendar year ie. The acronym is popularly known for monthly tax deduction among many Malaysians. RM4800 RM64800 RM69600 MTD for month of December is RM 696 and pay using Form CP39 only.

Most recomended using IE Browser. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Borang PCB TP3 2010.

E-PCB adalah sistem yang dibangunkan untuk kegunaan majikan membuat pengiraan Potongan Cukai Bulanan PCB. Borang PCB TP1 2012. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12.

Menyimpan maklumat pekerja dan bayaran PCBCP38. Paparan terbaik menggunakan pelayar ChromeInternet Explorer Versi Terkini atau Mozilla Firefox dengan resolusi skrin 1280x800. Kalkulator PCB Lembaga Hasil Dalam Negeri.

As in many other countries PCB is deducted at source. Store employee information and payment of PCBCP38. Jan 1 to Dec 31.

The employer or the company in question will then remit the amount deducted from the salary to the Inland Revenue Board by. Mengemukakan data bayaran PCBCP38 secara dalam talian.

E Pcb Manual E Pcb Portal Guide E Pcb Portal Video Tutorial Youtube

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Pcb Calculation For January 2011 Youtube

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

![]()

Inland Revenue Board E Pcb System

Most Comprehensive E Pcb Portal Guide Youtube

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Posting Komentar untuk "E Pcb Tax"